👔 Big 4 Visualized

🌈 Abstract

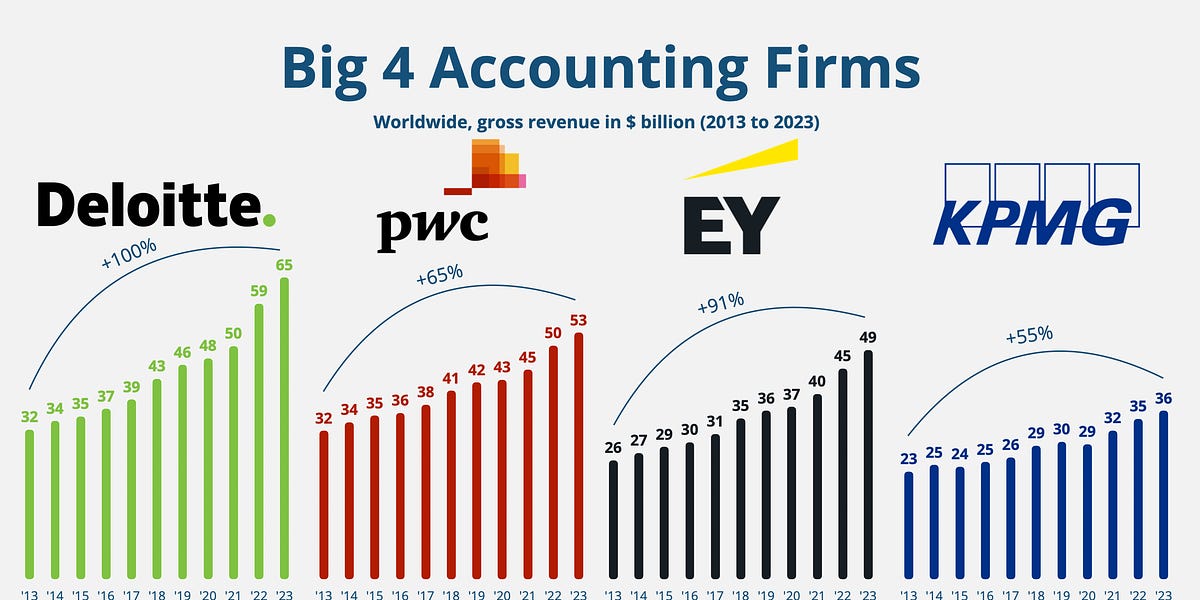

The article provides an overview of the "Big Four" accounting firms - Deloitte, PwC, EY, and KPMG - exploring their diverse revenue streams, growth strategies, and the challenges they face in maintaining audit independence amidst their expanding consulting and advisory services.

🙋 Q&A

[01] The Rise of the Big Four

1. What happened to Arthur Andersen, once a pillar of the accounting world?

- Arthur Andersen, a former "Big Five" accounting firm, was involved in the Enron scandal in 2002, which shattered its credibility and led to the firm's demise, marking the end of the "Big Five" era.

2. How have the remaining four accounting firms (Deloitte, PwC, EY, and KPMG) solidified their dominance?

- The collapse of Arthur Andersen allowed the remaining four firms to solidify their dominance in the accounting industry. They now audit most of the largest public companies and employ over 1.5 million people worldwide.

3. How has the revenue growth of the Big Four come at a cost?

- The Big Four's expansion of their consulting and advisory segments has led to conflicts of interest and numerous violations of regulations meant to ensure audit independence.

[02] The Big Four's Revenue Streams

1. What are the core services provided by the Big Four?

- The key revenue streams for the Big Four include:

- Audit: Independently verifying a company's financial statements to ensure accuracy and compliance with accounting standards.

- Assurance: Extending beyond basic audits, including processes, internal control, cybersecurity assessments, and fraud investigations.

- Consulting: Offering strategic advice on mergers and acquisitions, digital transformation, and other business areas.

- Enterprise Software Sales: Leveraging industry knowledge and client relationships to recommend and implement enterprise software solutions.

- Risk and Tax advisory: Helping businesses navigate compliance, regulations, and tax laws.

2. How has the revenue breakdown of the Big Four changed over time?

- The share of revenue from Audit & Assurance has decreased from 51% in 2013 to 31% in 2023, while the consulting and advisory segments have grown in importance.

[03] Insights on the Individual Big Four Firms

1. What are the key growth strategies and investments of Deloitte?

- Deloitte is heavily investing in AI and digital transformation, boosting its consulting and risk advisory services. It has also grown through strategic acquisitions of smaller consulting firms.

2. How is PwC leveraging AI and technology?

- PwC is investing $1 billion in a generative AI initiative with Microsoft to enhance efficiency and service offerings. It will also become the largest customer and first reseller of OpenAI's enterprise product.

3. What challenges has EY faced recently?

- EY abandoned its "Project Everest" plan to split its audit and consulting businesses due to partner disagreements, despite regulatory concerns. The firm has also faced criticism and fines related to its role in the Wirecard accounting scandal and employee cheating on ethics exams.

4. How is KPMG focusing on digital transformation and audit technology?

- KPMG is investing in data analytics, artificial intelligence, and cybersecurity, and continues to enhance its cloud-based audit platform, KPMG Clara. However, the firm has also faced regulatory scrutiny and fines in the UK related to its audit practices.

[04] Balancing Growth and Integrity

1. What is the key challenge the Big Four face in maintaining a balance between growth and integrity?

- As the revenue share of Audit and Assurance decreases in favor of Consulting, the Big Four must navigate conflicts of interest and maintain audit independence, to avoid repeating the cautionary tale of Arthur Andersen's demise.