Y-Combinator Guide: How to Split Equity between Cofounders & When You Should (and Shouldn’t) Split…

🌈 Abstract

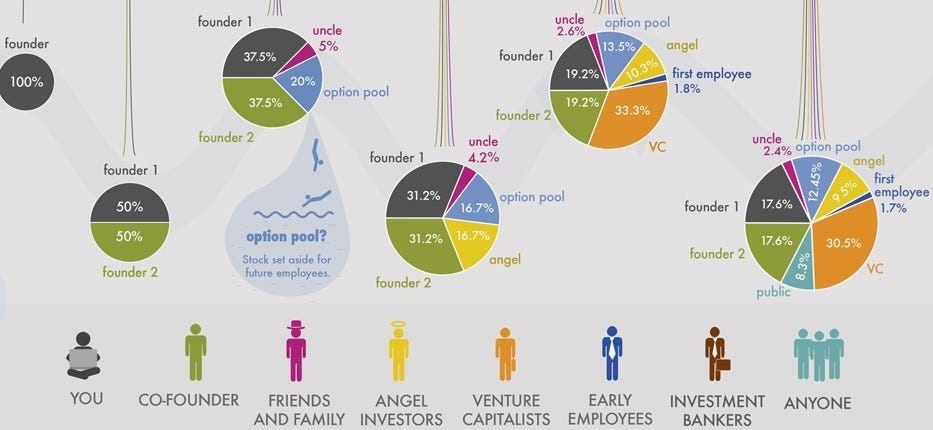

The article discusses the common mistakes founders make when splitting equity among co-founders, and provides advice on how to approach this important decision.

🙋 Q&A

[01] Founders' Mistakes in Splitting Equity

1. What are the common mistakes founders make when splitting equity?

- Splitting equity based on early work, such as:

- Coming up with the original idea

- Starting work before co-founders

- Taking a salary while co-founders did not

- Being older or more experienced than co-founders

- Bringing on co-founders after raising funds or launching an MVP

- These lines of reasoning are flawed because:

- Small variations in the first year do not justify massively different equity splits in years 2-10

- Startups often fail, so motivating all founders is important

- Unequal splits can signal that certain founders are not highly valued, which can deter investment

- Startup success relies more on execution than the original idea

2. What is the author's advice on splitting equity?

- Split equity equally (or close to equally) among co-founders

- These are the people you will work closely with for 7-10 years to build the company

- Equal splits signal that all founders are highly valued

- If you aren't willing to give your partner an equal share, perhaps they are not the right partner

[02] Importance of Equal Equity Splits

1. Why does the author believe equal or near-equal equity splits should become standard?

- All the hard work is still ahead, so small variations in early contributions do not justify large equity disparities later

- Giving founders larger equity stakes can increase their motivation and drive, which is important for startup success

- Investors view founder equity splits as a signal of how the CEO values their co-founders, and unequal splits can deter investment

- Startup success relies more on execution than the original idea, so the equity should not overemphasize the initial concept

Shared by Daniel Chen ·

© 2024 NewMotor Inc.