Overbuilding in AI: A Modern Twist on an Old Tale

🌈 Abstract

The article explores the overbuilding of AI infrastructure by major tech companies like Google, Amazon, Meta, and Microsoft, and how it echoes past investment booms in industries like canals, railways, and telecommunications.

🙋 Q&A

[01] Recent Earnings Calls and AI Infrastructure Investment

1. What did the recent earnings calls from big tech companies reveal about their commitment to AI-related infrastructure?

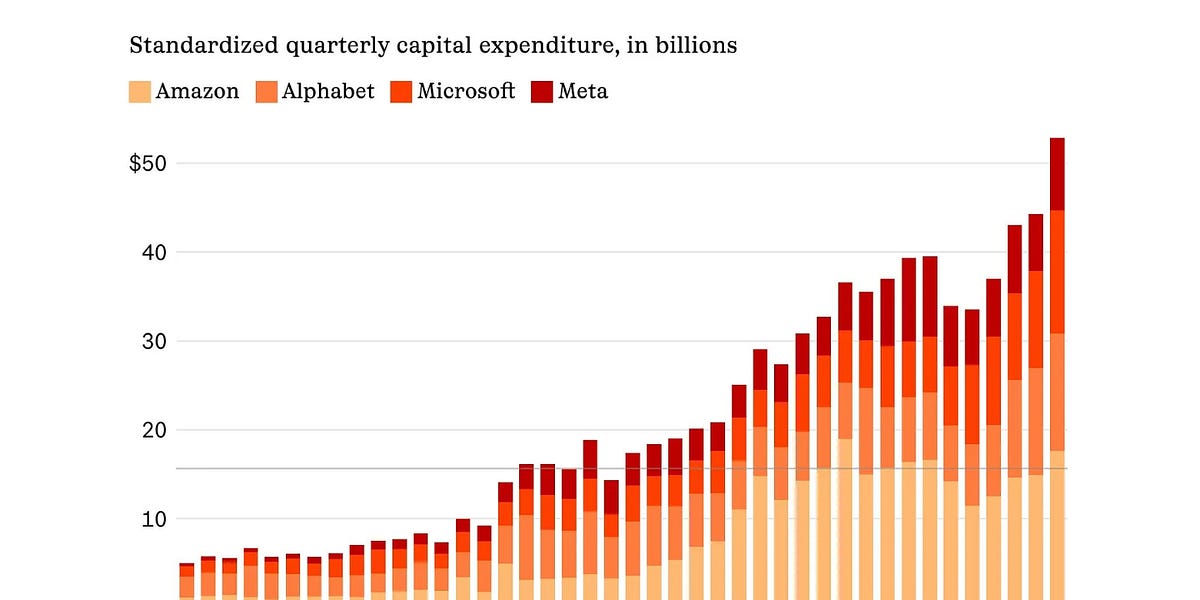

- The major tech companies (Google, Amazon, Meta, Microsoft) all shared a common message of continuing to ramp up their capital expenditures (capex) for AI infrastructure through 2025, with over $50 billion per quarter in aggregate capex by Q4 this year.

2. What was the common theme across these calls regarding potential overbuilding?

- There was an acknowledgment of the potential for overbuilding, but the consensus was that the risk of underinvesting is far scarier than over-investing.

3. How did the tech leaders justify this aggressive investment approach?

- Mark Zuckerberg noted that while there's a "meaningful chance" of over-building, the downside of being behind in this critical technology for the next 10-15 years is much greater.

- Sundar Pichai echoed this sentiment, stating that when going through a transformative technology shift, the risk of underinvesting is dramatically greater than the risk of overinvesting.

[02] Historical Parallels and Unique Characteristics

1. What are some historical examples of massive infrastructure buildouts fueled by the fear of missing out?

- The article cites examples of overbuilding in canals, railways, and telecommunications, where sudden investment surges led to both innovation and excess.

2. How does the current AI boom differ from these past investment cycles?

- One key difference is the presence of stronger demand signals today, unlike past cycles where infrastructure was built on the hope and expectation that demand would follow.

- Another difference is the flexibility of today's infrastructure, which has a long useful life, can be repurposed, and allows for aligning spending with actual demand.

- The current cycle is also more centralized, with the bulk of AI infrastructure investment concentrated in the hands of just 5-7 major players, unlike the more speculative, decentralized overbuilding of the past.

3. What are the potential risks associated with the current AI infrastructure buildout?

- The article notes that overbuilding, even when driven by real demand, comes with significant risks, and the key question is whether the demand for AI will keep pace with this rapid expansion, or if supply will outstrip demand as in previous cycles.