Zapier: The $7B Netflix of Productivity

🌈 Abstract

The article provides an in-depth analysis of Zapier, a no-code integration platform that has grown to $140M in annual recurring revenue (ARR) on just $1.4M in venture capital. The report covers Zapier's valuation, growth, competitive landscape, and future outlook.

🙋 Q&A

[01] Zapier's Valuation and Growth

1. What is Zapier's current valuation and how does it compare to the authors' estimate? The article states that Zapier was recently valued at around $5B, but the authors estimate Zapier to be worth around $7B based on its growth rate, market penetration, and public company comparables.

2. How has Zapier achieved such rapid growth with minimal venture capital? Zapier has been able to reach $100M ARR in under 10 years, which is faster than companies like Shopify and Carta despite raising only $1.4M in venture funding. This has given Zapier a very high ARR to funding ratio, putting it in elite company with bootstrapped businesses like Atlassian and Cloudinary.

3. What are the key drivers of Zapier's growth? Zapier's growth has been fueled by its SEO-driven marketing strategy, which has allowed it to programmatically generate thousands of landing pages that rank highly for integration-related searches. This has driven 6M+ monthly unique visitors to Zapier's site.

[02] Competitive Threats to Zapier

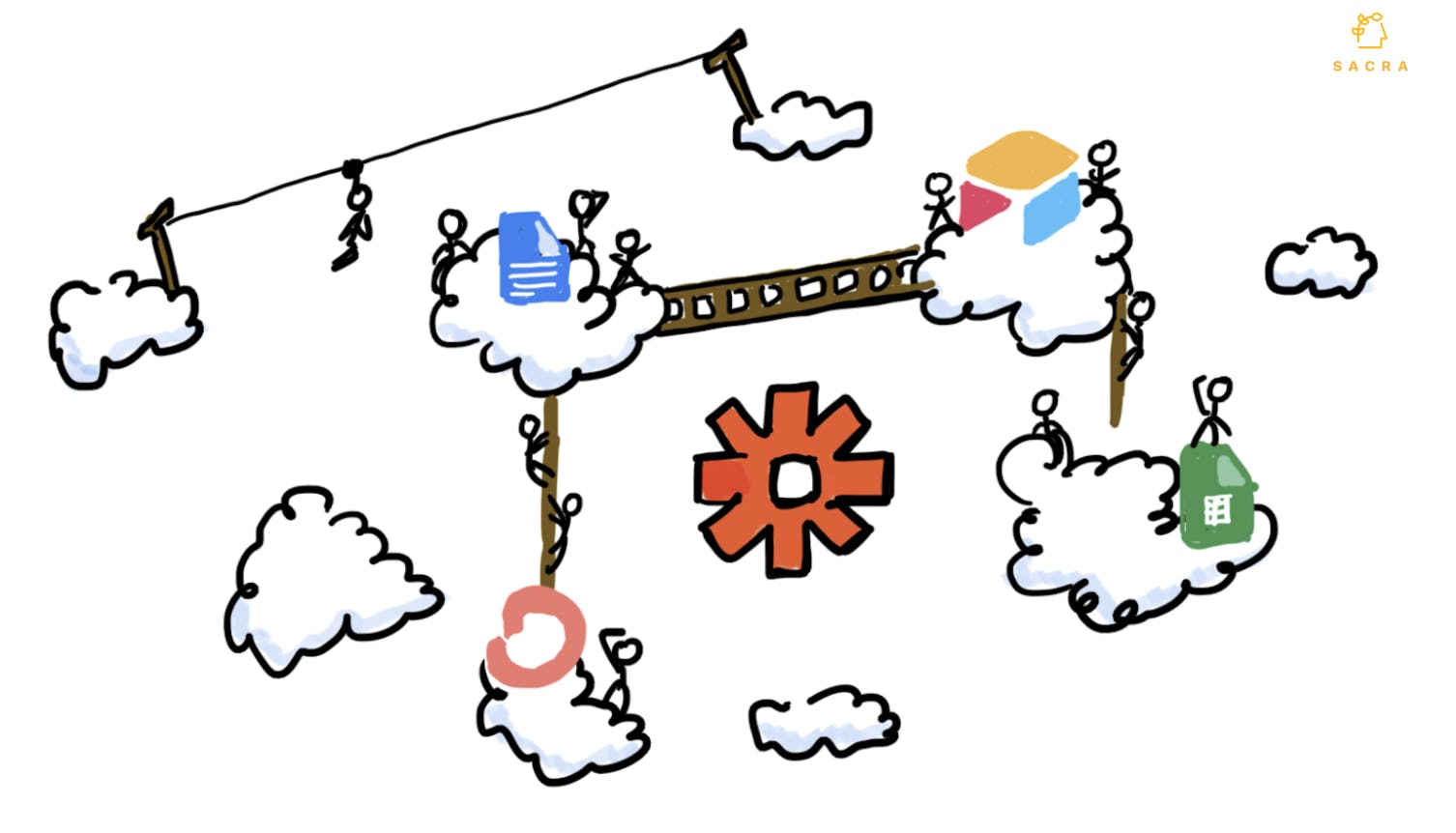

1. What are the main competitive threats facing Zapier? The article outlines three key threats:

- Disintermediation from native integration APIs like Tray.io and Paragon

- Competition from verticalized automation solutions like Alloy Automation and Parabola

- Airtable and other platforms building their own integration tools to keep users on their platforms

2. How could these competitive threats impact Zapier's business? If Zapier is unable to address these threats, it could relegate Zapier to serving the "long tail" of integrations, with most SaaS products building their most popular integrations in-house. This could slow Zapier's growth and reduce its pricing power.

[03] Zapier's Path Forward

1. What strategic options does Zapier have to defend its position? The article suggests that Zapier could build its own data store and become a "no-code super aggregator", similar to how Netflix evolved from a content distributor to an original content producer. This would allow Zapier to own more of the user experience and data, rather than being reliant on partners like Airtable.

2. What are the potential benefits and risks of Zapier pursuing this strategy? Owning the data layer could allow Zapier to provide a more seamless, native-like integration experience for users. However, it would also put Zapier in more direct competition with some of its current partners, which could strain those relationships.