How Many SaaS Companies Are There? (2024)

🌈 Abstract

The article provides an in-depth analysis of the Software as a Service (SaaS) market, covering key insights, statistics, and trends. It examines the growth and evolution of the SaaS industry, including the number of SaaS companies worldwide, their geographic distribution, market size, and end-user spending. The article also highlights the top SaaS-producing countries, the leading SaaS companies, and the projected future growth of the SaaS market.

🙋 Q&A

[01] Overview of the SaaS Market

1. What are the key insights into the SaaS market covered in the article?

- The article provides the following key insights into the SaaS market:

- There are approximately 17,000 SaaS companies worldwide, with the majority (9,100) based in the United States.

- The top SaaS-producing countries are the United States, United Kingdom, Canada, Germany, and India.

- Within the 17,000 SaaS companies, an estimated 337 are classified as unicorns, and around 15 are decacorns.

- The US has a staggering 54 billion SaaS customers, more than all other nations combined.

- The number of SaaS startups launched increased year-over-year from the early 2000s to the mid-2010s, but has since declined.

2. What are the trends in the growth of the SaaS market?

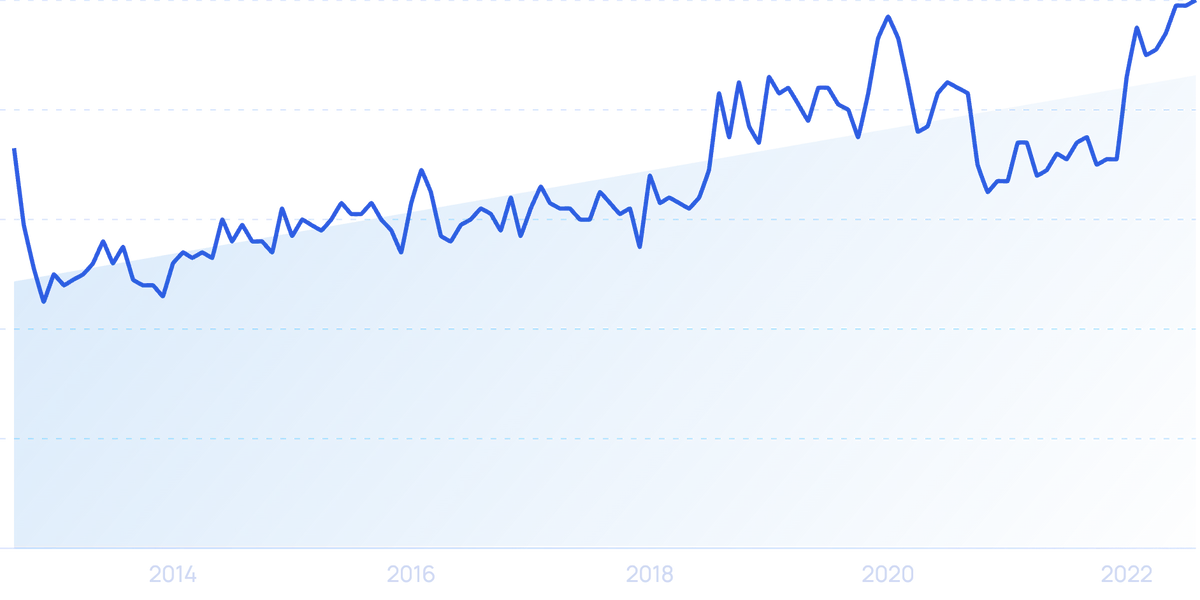

- The cloud application market has grown significantly over the last decade, from an estimated $30.4 billion in 2013 to $146.6 billion in 2022, and is expected to reach $168.6 billion by 2025.

- The SaaS market has also grown in value year-over-year, from just over $5 billion in 2008 to $157 billion in 2020.

- Global SaaS end-user spending has increased over 5 times in less than 10 years, reaching approximately $176.62 billion in 2022.

[02] Geographic Distribution of SaaS Companies

1. Which countries have the most SaaS companies?

- The top SaaS-producing countries are:

- United States (9,100 SaaS companies)

- United Kingdom (1,500)

- Canada (992)

- Germany (840)

- India (711)

2. How is the distribution of SaaS companies across different regions?

- North America (primarily the United States) accounts for 58.6% of the global SaaS companies.

- Europe accounts for 26.5% of the global SaaS companies, with 11 of the top 20 SaaS-producing countries located in Europe.

- Asia accounts for 10.5% of the global SaaS companies.

- Oceania and South America account for 2.4% and 2% of the global SaaS companies, respectively.

[03] Market Share and Growth of Top SaaS Companies

1. What are the market shares of the top 5 SaaS companies?

- The top 5 SaaS companies and their market shares are:

- Salesforce - 9.3%

- Microsoft - 8.7%

- SAP - 4.7%

- Oracle - 4%

- Google - 3.8%

2. How have the revenue and growth of these top SaaS companies changed over time?

- Salesforce's revenue has increased from $8.39 billion in 2017 to $21.25 billion in 2021, a 153.28% increase.

- Microsoft's annual revenue has increased each year since 2016, with the biggest jump being a 17.53% increase from 2020 to 2021.

- SAP's revenue grew from $10.67 billion in 2009 to $27.84 billion in 2021, a 159.04% increase.

- Oracle's revenue has remained largely unchanged over the last decade, but the company has shifted its focus towards cloud services and license support.

- Google's cloud revenue has skyrocketed from $4.06 billion in 2017 to $19.21 billion in 2021.

[04] Future Outlook and Trends

1. What is the projected growth of the SaaS market?

- The SaaS market is projected to grow at a CAGR of 11.7% between 2020 and 2026, reaching a valuation of $307 billion.

- The US SaaS sector is expected to more than double in value, reaching €191 billion ($202.2 billion) by 2025.

- The UK's SaaS sector is forecast to almost double to €14.5 billion ($15.4 billion) by 2025.

- China's SaaS market is predicted to experience the most growth, jumping from €4 billion ($4.2 billion) in 2020 to €13 billion ($13.8 billion) in 2025.

2. What are the key trends and investments in the SaaS industry?

- SaaS is currently responsible for around 70% of company software use, and this figure is forecast to rise to 85% by 2025.

- Within IT security, cloud security spending is projected to grow the most, at 41.2% in 2021, compared to 17.5% for data security and 16.8% for infrastructure protection.

- A 2020 survey showed that respondents expect cloud vendors, particularly Microsoft Azure, to see significant increases in business spending.