A Deep Dive on AI Inference Startups

🌈 Abstract

The article discusses the rise of AI-as-a-Service (AaaS) startups, particularly those focused on AI inference abstraction. It covers the following key points:

🙋 Q&A

[01] Why there's a need for AI inference abstraction

- Before AaaS, companies faced challenges in building and maintaining AI inference infrastructure, such as orchestrating GPU fleets, managing configurations, and optimizing for utilization and elasticity.

- AaaS platforms allow companies to use off-the-shelf or custom-trained models, deploy them, and access them via an API, without having to manage the underlying infrastructure complexity.

[02] Convergence in developer experience, performance, and pricing

- AaaS platforms offer two main layers of abstraction: API-only (e.g. Replicate, Fireworks AI) and customizable "in-between" experiences (e.g. Modal, Baseten).

- Performance metrics like token generation throughput have largely converged across top platforms, indicating rapid commoditization.

- Pricing has also converged, though margins may differ as larger players can optimize infrastructure costs more efficiently.

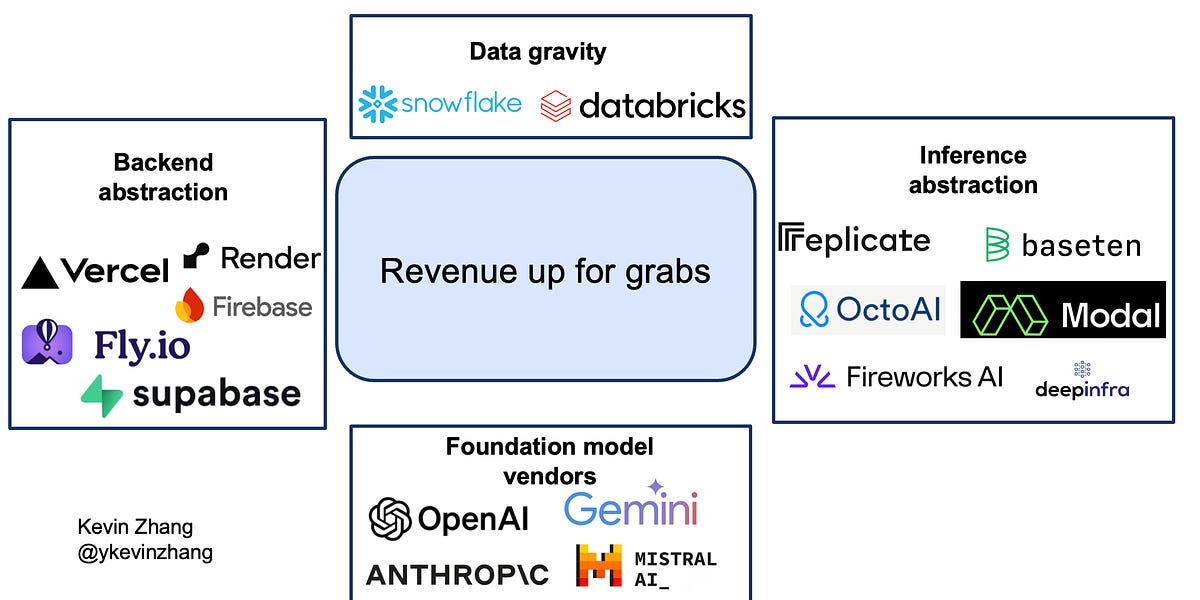

[03] Competitive dynamics and constrained TAM

- Key competitors include foundation model vendors, data lakehouse platforms, and backend abstraction platforms (e.g. Vercel, Render).

- The current available TAM for AaaS is highly constrained, estimated to be under $1 billion in revenue.

[04] Investor considerations for AaaS startups

- Investors need to believe in massive TAM expansion, product expansion, and potential M&A opportunities to justify the high entry prices.

- Only megafunds have the capital required to "play" at this layer, as winning requires significant R&D, sales/marketing, and subsidizing usage in the short term.

[05] Impact on startups building AI features

- In the short term, startups can benefit from the faster time-to-market enabled by AaaS platforms.

- In the longer term, distribution and existing customer relationships will be more important as features become commoditized, favoring incumbents and startups that can grow into market leaders.

Shared by Daniel Chen ·

© 2024 NewMotor Inc.