What Are We Seeing As VCs - Summer 2024 Edition ☀️

🌈 Abstract

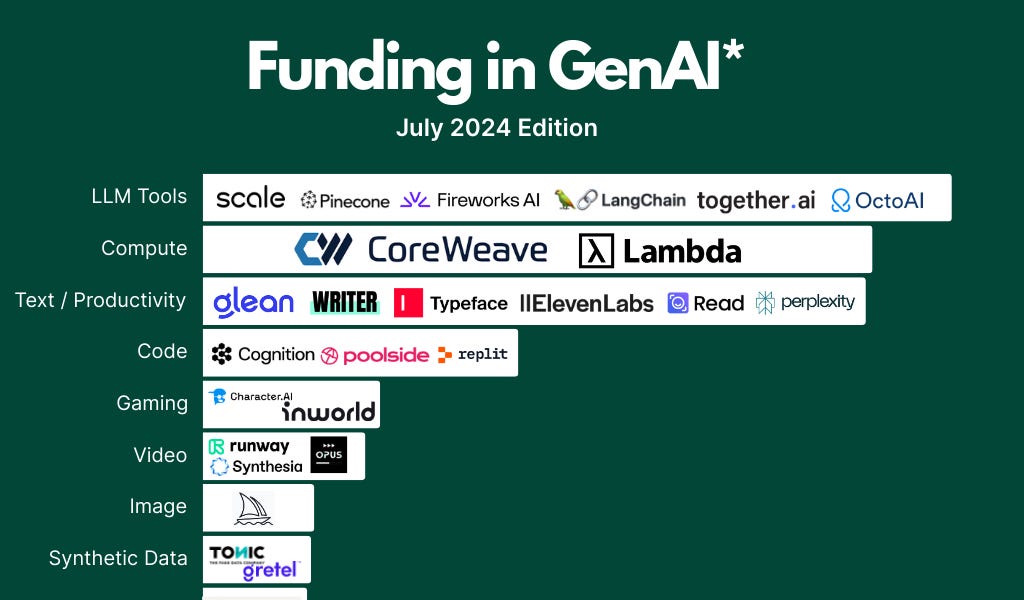

The article discusses the current state of the AI startup ecosystem, including trends in fundraising, the bifurcation between successful and struggling companies, and the evolving landscape of generative AI.

🙋 Q&A

[01] Overview of AI Startup Landscape

1. What are the key observations about the AI startup fundraising market?

- Q1 2023 saw a surge in funding after the release of ChatGPT, but the following quarters did not see the same level of investment

- Q2 2023 saw the highest amount of dollars invested in the category on record, a 300% increase year-over-year

- This was driven by several "megadeals" to large foundation model companies like xAI, Coreweave, ScaleAI, and Mistral

- However, US pre-seed and seed deals have seen a sharp decline in both deal value and deal count

2. What are the reasons behind the decline in early-stage AI startup funding?

- Many early-stage VCs invested in a variety of pre-seed and seed-stage GenAI companies in 2023 and are now waiting to see their performance

- Established "Gen-enhanced" companies like Canva, Notion, and Zapier have added advanced GenAI features, making it harder for new challengers to enter

- There is a narrowing scope for new entrants as building new foundation models is no longer a focus for startups

3. How is the venture capital flowing in the AI startup ecosystem?

- Over $7 billion has poured into foundation model "megadeals" this year, with the majority going to large LLM providers like Anthropic, Mistral AI, and xAI

- Venture dollars are consolidating around technical founders building companies with product or go-to-market moats and a path to category leadership

- Mega-rounds are becoming more common as investors focus on "best-in-class" AI startups

[02] Factors Driving Success for AI Startups

1. What are the key factors that have enabled some AI startups to find early success?

- Understanding how to securely and compliantly leverage customer data to improve model performance

- Having early access to GPUs or the most performant AI models, giving them an initial unfair advantage

- Integrating their products deeply into workflows and replacing manual tasks, proving immediate ROI

- Entering niche verticals overlooked by industry incumbents, where AI is proving more performant

2. What are some examples of successful AI startups in specific verticals?

- Legal: Harvey recently raised $100 million at a $1.5 billion valuation

- Financial Services: Hebbia raised $130 million at a $700 million post-money valuation

- Healthcare: Hippocratic AI raised $55 million at a $500 million post-money valuation

[03] Outlook and Trends

1. How does the article characterize the current state of the AI startup ecosystem?

- The article notes that the AI ecosystem is experiencing "juxtapositions" - the number of companies being funded is dropping as many struggle to find sustainable product-market fit, while at the same time, "megarounds" are converging around emerging industry leaders.

- The article is optimistic about the long-term potential of AI, noting that we are still in the early innings and the pace of change will only accelerate.

- Big tech companies like Microsoft, Meta, Google, Nvidia, and OpenAI remain highly active in the space, releasing new models, investing in startups, and making acquisitions.

- The article predicts that AI-native startups that have moved past product-market fit are now scaling rapidly, and we could see the first AI-native IPO in the next 12-24 months.

Shared by Daniel Chen ·

© 2024 NewMotor Inc.