Eschewing IPOs: What happens when SaaS companies stay private for longer

🌈 Abstract

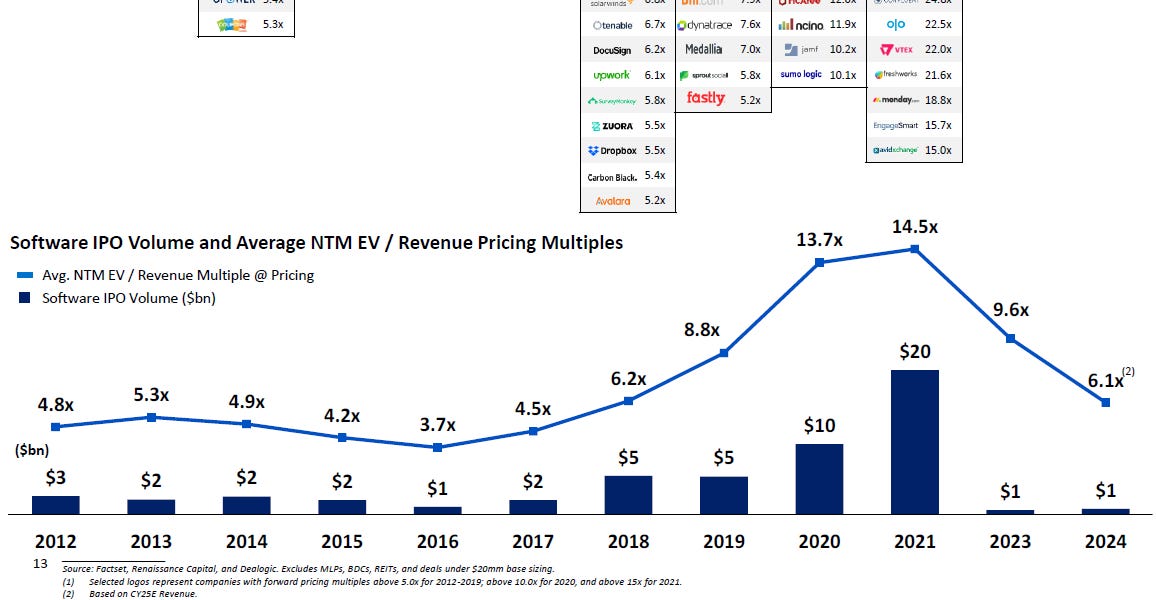

The article discusses the recent trends in the SaaS IPO market, including the maturity of SaaS companies going public, the implications for employees, VCs, and public market investors, as well as the debate around the optimal timing for companies to go public.

🙋 Q&A

[01] SaaS IPO Trends

1. What are the key trends observed in the SaaS IPO market?

- The SaaS IPO environment has been muted throughout 2024, with only a few major SaaS IPOs like Rubrik's

- However, there are signs of a potential resurgence in SaaS IPOs, with the recent S-1 filing by OneStream

- A maturity trend is emerging, where SaaS companies are going public at a much older age (median of 11 years) compared to the 1980-2000 period (median of 8 years)

2. What are the implications of SaaS companies staying private for longer?

- For employees, especially early joiners, it could result in a longer time until they can experience liquidity

- For VCs, the extended timeline for holding private assets may require evolving underwriting assumptions and create liquidity pressure for limited partners (LPs)

- For public market or retail investors, the longer private period could mean less value creation and accretion post-IPO

3. What are the different perspectives on the optimal timing for companies to go public?

- Some argue that founders should re-examine their beliefs about the necessary milestones (such as scale) before going public

- Others point out that the "dearth of software IPOs" is due to mismatched expectations, not a "shuttered IPO market", as many high-growth software companies can IPO but may need to overcome an initial valuation hit

[02] Private-Public Market Valuation Disconnect

1. What is the private-public market valuation disconnect discussed in the article?

- The article mentions that the author has previously written extensively about the valuation disconnect between private and public markets for software companies

- An updated visual of this phenomenon is provided in the chart included in the article

2. How does the author expect this valuation disconnect to be resolved?

- The author suggests that the private-public market valuation disconnect will take time to unravel, and does not expect a sudden reversal in exit trends anytime soon.

Shared by Daniel Chen ·

© 2024 NewMotor Inc.