A Deep Dive on AI Inference Startups

🌈 Abstract

The article discusses the rise of AI-as-a-Service (AaaS) startups, particularly those focused on AI inference, and the implications for software development and investment strategies.

🙋 Q&A

[01] Why there's a need for AI inference abstraction

- Companies previously faced challenges in building and maintaining AI infrastructure, such as orchestrating GPU fleets, managing configurations, and optimizing for utilization and elasticity.

- AI inference abstraction platforms allow companies to use off-the-shelf or custom-trained models, deploy them, and access them via an API, without having to build the underlying infrastructure.

[02] Convergence of developer experience, performance, and price

- There are two main layers of abstraction: API-only platforms that completely hide complexity, and platforms that offer more customizable "knobs" for developers.

- Performance and pricing across the top platforms have largely converged, indicating rapid commoditization in the AI inference space.

[03] Competitive dynamics and constrained TAM

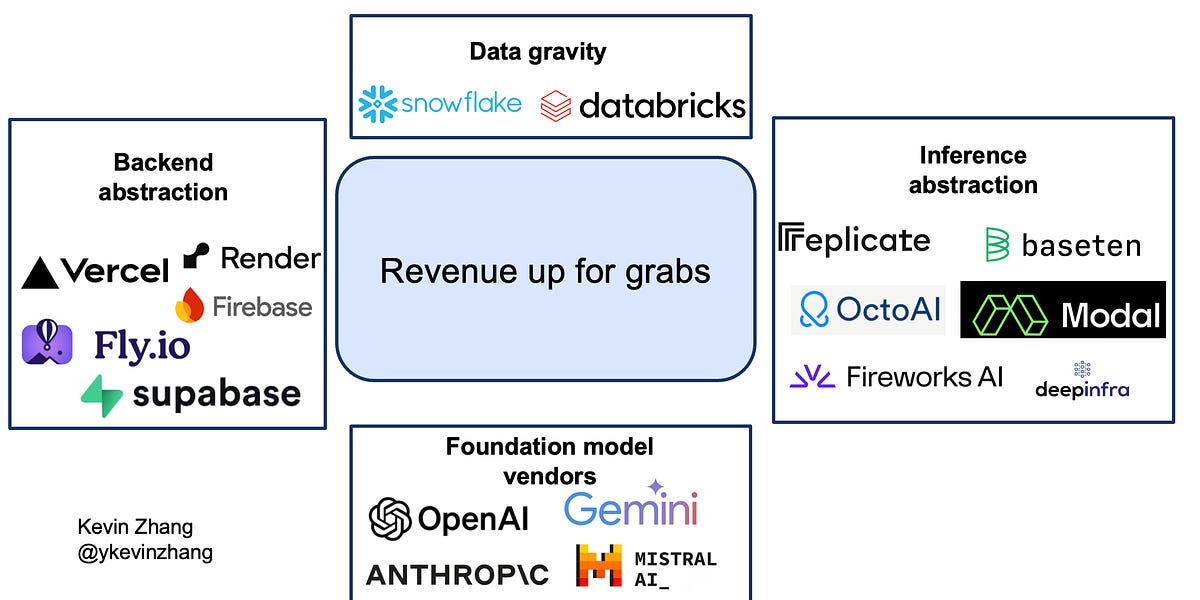

- The main competition comes from foundation model vendors, data lakehouse platforms, and backend abstraction platforms (PaaS providers).

- The current available TAM for AI inference abstraction is highly constrained, estimated to be under $1 billion in revenue.

[04] Investor beliefs for AI inference companies

- Investors need to believe in massive TAM expansion, product expansion, and potential M&A opportunities to justify the high entry prices.

- The capital-intensive nature of winning in this market makes it a game for only the largest venture funds.

[05] Impact on software startups

- In the short term, startups can benefit from the faster time-to-market enabled by AI inference abstraction platforms.

- In the longer term, distribution and existing customer relationships will be more important as the market becomes commoditized, favoring incumbents and startups that can grow into market leaders.

Shared by Daniel Chen ·

© 2024 NewMotor Inc.