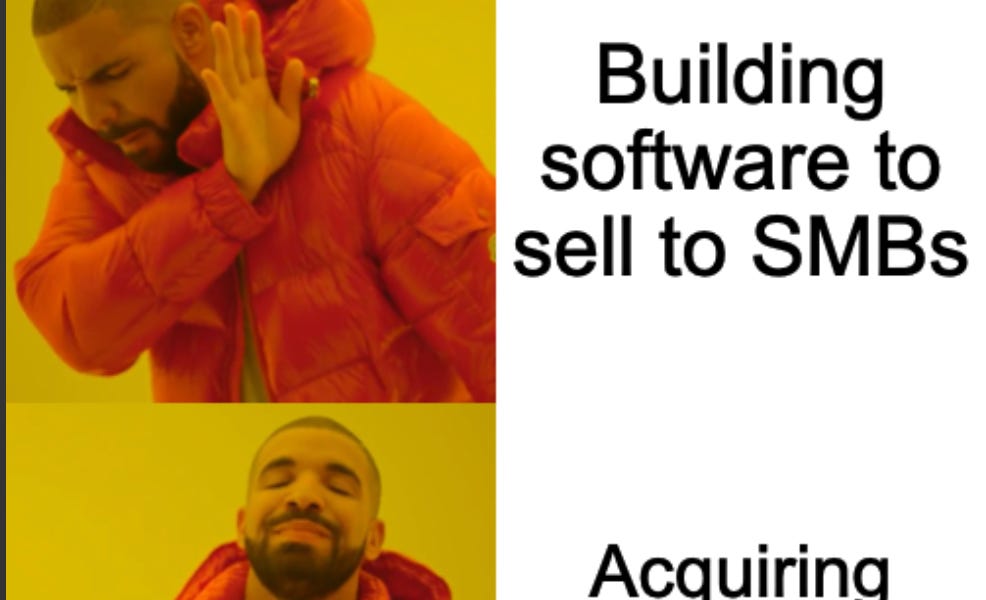

Stop Building SaaS for SMBs—Buy Them Instead

🌈 Abstract

The article discusses the opportunity for founders interested in the small and medium-sized business (SMB) market to acquire SMBs and build their dream technology around them, rather than trying to sell directly to SMBs. It argues that this approach can be more profitable and less risky than the traditional SaaS model for SMBs.

🙋 Q&A

[01] Building B2B SaaS for SMBs

1. What are the challenges founders face when building B2B SaaS for SMBs?

- Low Average Contract Values (ACVs) and fewer seats to sell to, resulting in the need for more customers to generate the same revenue

- Longer sales motions, as SMB owners often want to meet in person or have a local presence, rather than doing deals over Zoom

- Reluctance of SMB owners, often older generation, to adopt new technologies and a preference for having work done for them rather than using apps or chatbots

- Difficulty in reaching SMBs, as many are not on LinkedIn, don't regularly check emails, and don't trust strangers on the internet, making it hard to scale the go-to-market motion

2. What is the alternative approach the article suggests? The article suggests that founders can acquire SMBs instead of trying to sell directly to them. This allows them to:

- Capture the full savings from automating the SMB's operations, rather than just a percentage of the savings

- Grow the revenue of the acquired SMB by focusing on increasing revenue per employee

- Leverage the acquired SMB as a zero-churn customer to scale the technology and acquire more SMBs

[02] Acquiring and Automating SMBs

1. What are the benefits of acquiring and automating SMBs compared to the traditional SaaS approach?

- Higher potential returns, with the ability to capture $500K-$1M in annual savings or revenue growth, compared to only a few hundred thousand in the SaaS scenario

- Easier revenue growth, as growing a business from $5M to $6M is easier than growing from $0 to $1M

- Generation of valuable proprietary data to handle and automate edge cases, leading to even greater levels of automation in the future

- Larger total addressable market (TAM), as the opportunity is now the entire IT services space rather than just the software spend of SMBs

- Ability to leverage future AI progress to achieve better margin structure

- Increased valuation potential, as the business can be scaled and sold for 10-20x EBITDA

2. What are the key considerations for executing this acquisition and automation strategy?

- Ensuring the team has the necessary expertise in M&A, deal structuring, and managing a service-based business

- Maintaining founder-market fit and developing best-in-class standard operating procedures and playbooks

- Focusing on acquiring businesses in large, highly fragmented industries with recurring revenue and a software TAM that is too small for a VC-backed company