Clouded Judgement 6.14.24 - Is Seat Based Pricing Dead?

🌈 Abstract

The article discusses the potential impact of AI on the SaaS business model, the shift towards consumption-based pricing, and the future of application software.

🙋 Q&A

[01] Is Seat Based Pricing Dead?

1. What are the issues with seat-based pricing models for infrastructure/dev tools software companies?

- Seat-based pricing models don't align the value delivered with the price charged, as they can undercharge for high-usage scenarios.

- Seat-based pricing models can negatively impact the vendor's margin structure, as increased product usage creates incremental marginal costs without generating incremental revenue.

2. How will the rise of AI impact application software companies and their pricing models?

- The promise of AI to allow customers to "do more with less" (i.e., fewer people/seats) will put pressure on application software companies' average contract values (ACVs) and margins.

- Application software companies will likely need to pivot to consumption-based pricing models to align value delivered with price charged, as seat-based models will become less viable.

3. How will the future of application software evolve with the rise of AI?

- The focus will shift from easy-to-use UIs to optimized data structures and architectures that enable efficient AI agent consumption.

- Application software will become more tightly integrated with leading data platforms, as these platforms become the foundation for AI-powered applications.

- Data infrastructure companies may evolve to become the application providers themselves, building applications on top of their data platforms.

[02] May Inflation (CPI) Update

1. What were the key highlights from the May CPI data?

- May CPI year-over-year was 3.3% vs. expectations of 3.4%, and down from 3.4% in April.

- May CPI month-over-month was 0.0% vs. expectations of 0.1%, and down from 0.3% in April.

- May core CPI (excluding food and energy) year-over-year was 3.4% vs. expectations of 3.5%, and down from 3.6% in April.

2. How did the May inflation data impact the market's expectations for future Fed rate changes?

- The market's expected future Fed Funds rate decreased slightly after the May inflation data, with the expectation shifting from one rate cut by year-end to two rate cuts by year-end.

[03] Quarterly Reports Summary

1. What are the key operating metrics and valuation multiples summarized in the article?

- Median NTM (next 12 months) revenue growth rate: 12%

- Median LTM (last 12 months) revenue growth rate: 17%

- Median gross margin: 76%

- Median operating margin: -10%

- Median FCF (free cash flow) margin: 14%

- Median net retention rate: 110%

- Median CAC (customer acquisition cost) payback period: 53 months

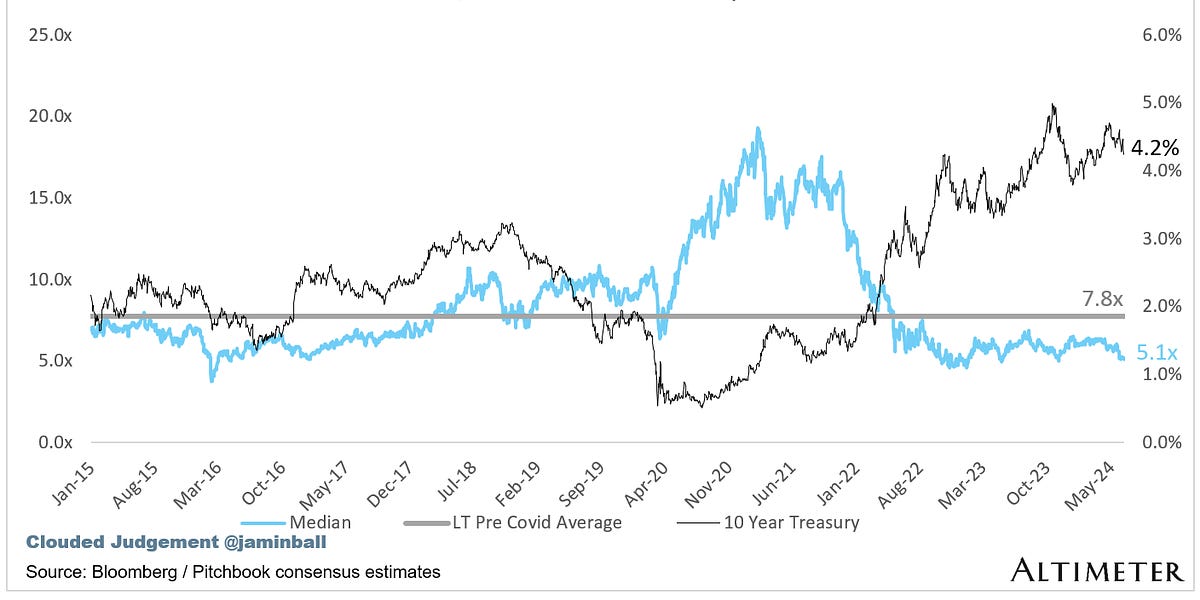

- Median EV/NTM revenue multiple: 5.1x

- Median EV/NTM revenue multiple for high-growth companies: 7.9x

- Median EV/NTM revenue multiple for mid-growth companies: 7.9x

- Median EV/NTM revenue multiple for low-growth companies: 3.5x

2. How does the article analyze the relationship between valuation multiples and revenue growth?

- The article includes a scatter plot showing the correlation between EV/NTM revenue multiples and NTM revenue growth rates.