Better Tools, Bigger Companies

🌈 Abstract

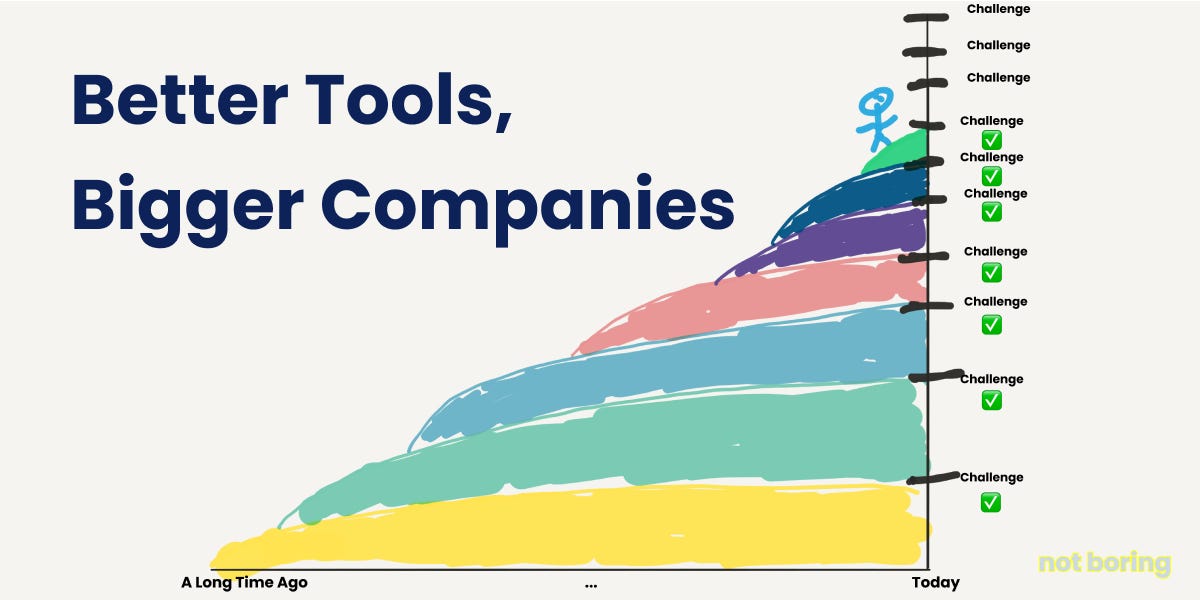

The article discusses the rise of "Techno-Industrials" - companies that use cutting-edge technologies to tackle large, physical challenges in industries like energy, mining, and aerospace. The author argues that we are in a period where the tools available to entrepreneurs have become powerful enough to allow them to build much bigger companies than ever before by disrupting traditional industries. The article covers the following key points:

🙋 Q&A

[01] Technologies are Cumulative Tools

1. What is the author's view on how technologies have evolved over time? The author argues that technologies are cumulative tools that allow humans to build increasingly complex and ambitious solutions. As new technologies are developed and added to the global toolkit, entrepreneurs can use them to tackle ever-grander challenges. This has led to an "embarrassment of riches" in terms of the tools available today.

2. How does the author contrast information industries vs. matter industries? The author distinguishes between "information industries" like finance and knowledge work, which can be disrupted primarily through software, and "matter industries" like energy and manufacturing, which require physical solutions integrating both hardware and software.

3. What is the author's view on the potential of Techno-Industrials compared to pure software companies? The author believes that Techno-Industrials have the potential to create more value and wealth over the next decade than pure software companies, as the combination of atoms and bits is more powerful than bits alone. He expects to see Techno-Industrials with higher market caps than the largest current incumbents in physical industries.

[02] Investing in Techno-Industrials

1. What are some of the common concerns investors have about investing in Techno-Industrials? Investors are often skeptical about the science risk, capital intensity, and lack of familiarity with the physical industries that Techno-Industrials operate in. The author addresses these concerns, arguing that the best Techno-Industrial teams are thoughtful about financing and more capital efficient than expected.

2. How does the author recommend evaluating Techno-Industrial companies? The author suggests that rather than evaluating the science risk, investors should focus on evaluating the team's ability to make the possible practical and economical. He also highlights the importance of understanding the companies' financing strategies, which often involve alternative sources beyond just venture capital.

3. What is the author's overall investment thesis for Techno-Industrials? The author believes that backing the most credible teams tackling incredibly big challenges using the best available tools is a winning investment strategy. He expects dozens of $100 billion outcomes as Techno-Industrials disrupt traditional industries.