Investment Case for GenAI Apps x Financial and Professional Services

🌈 Abstract

The article discusses the potential of Generative AI (GenAI) to transform the financial and professional services industries. It highlights the significant market opportunity for GenAI applications, which is estimated to be over 10 times the size of the current software market. The article also covers the rapid enterprise adoption of GenAI, with financial services firms driven by a fear of missing out, and the willingness of Fortune 500 firms to partner directly with early-stage startups in this space.

🙋 Q&A

[01] The Potential of GenAI in Financial and Professional Services

1. What are the key points made about the potential of GenAI in the financial and professional services industries?

- The author has experience in various roles in the financial and professional services industries, as well as in the tech industry as an operator and founder.

- The author believes we are at a pivotal moment for the next big technology (GenAI) to augment or disrupt an industry worth tens of trillions of dollars.

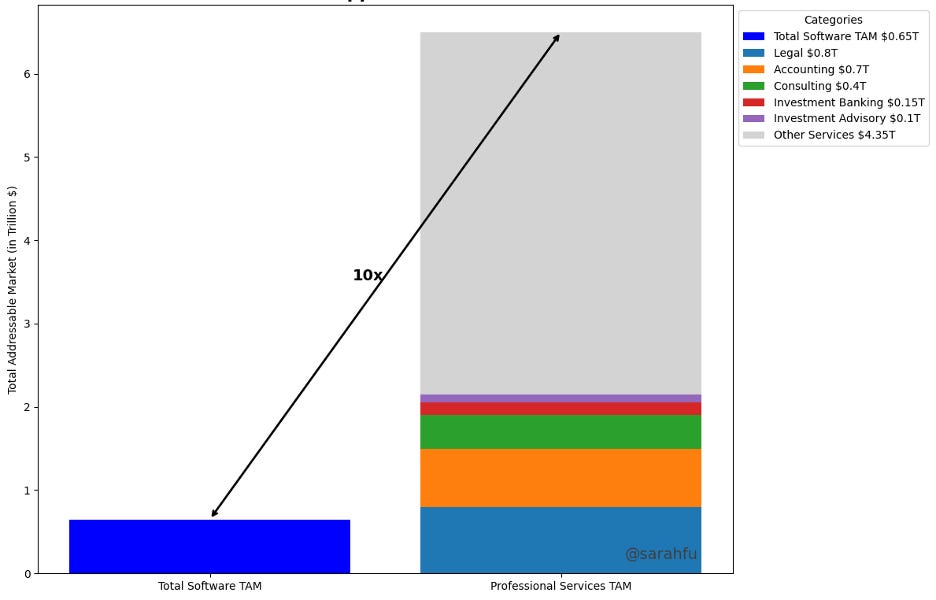

- The total addressable market (TAM) for GenAI applications is more than 10x that of SaaS, as it has the potential to replace services with software.

- The professional services sector is a $6.5 trillion market, including areas like legal, accounting, consulting, investment banking, and investment advisory services, which could be disrupted or augmented by GenAI.

- The application side of GenAI is still in its early stages, with substantial white space for future value creation, compared to the hardware and infrastructure side.

2. How does the potential of GenAI compare to previous technology waves?

- The author believes the potential of GenAI to create significant market value is greater than the previous technology wave of cloud computing, which predominantly impacted software by replacing on-prem solutions with cloud.

- The author notes that the combined market cap of SaaS-native application companies is around $1.1 trillion, while the B2B application side of GenAI remains wide open for new players to potentially create $1 trillion+ in market value.

[02] Enterprise Adoption of GenAI

1. What are the key observations on the current state of enterprise adoption of GenAI in financial and professional services firms?

- Financial services firms are driven by a fear of missing out (FOMO), pushing them to adopt the latest AI tools to stay competitive.

- Even the earliest-stage GenAI startups have been successful in securing meetings directly with C-level leadership of large financial services enterprises, some of which have turned into paid pilots.

- In some cases, financial services firms are pitching startups on the value that GenAI can bring to them, focusing on both near-term efficiency savings and longer-term revenue and alpha-generating opportunities.

- The demand from enterprise financial services firms is strong, contrasting with the typical outbound sales efforts seen in SaaS, indicating a higher level of market readiness to adopt GenAI technology.

- Enterprises are setting aside specific GenAI budgets to experiment with and try out AI tools, separate from core technology budgets such as SaaS spending.

- Use cases with strong value propositions are starting to emerge, especially in areas typically viewed as grunt work, where GenAI tools can reduce completion time by more than 80%.

- GenAI has consistently been viewed as a top strategic priority by CEOs of the largest financial services firms, unlike prior technology waves that often fell under the job of CTOs.