How AI Disrupts Tech Investing

🌈 Abstract

The article discusses the changing landscape of the tech industry, particularly the impact of AI on startups, investing, and the broader economy. It highlights the rise of solopreneurs and content creators as new models of entrepreneurship, the disruption of traditional tech companies by AI-powered startups, and the challenges this poses for venture capitalists and public market investors.

🙋 Q&A

[01] The Rise of AI Startups

1. What are the key factors enabling the rise of AI startups?

- The article highlights two key factors enabling the rise of AI startups:

- AI enables new services that were previously impossible

- AI helps people build services faster and cheaper than ever before, through features like faster coding, increased security, and the ability for less experienced developers to become productive

2. How is AI impacting the cost and ease of building startups?

- The article explains that AI has "supercharged" the process of reducing the cost of building startups, by making coding much faster and enabling less experienced developers to become productive. This democratization of software development means individuals or small teams can now build and test ideas with little to no upfront capital.

3. What are some examples of successful solopreneurs leveraging AI to build profitable businesses?

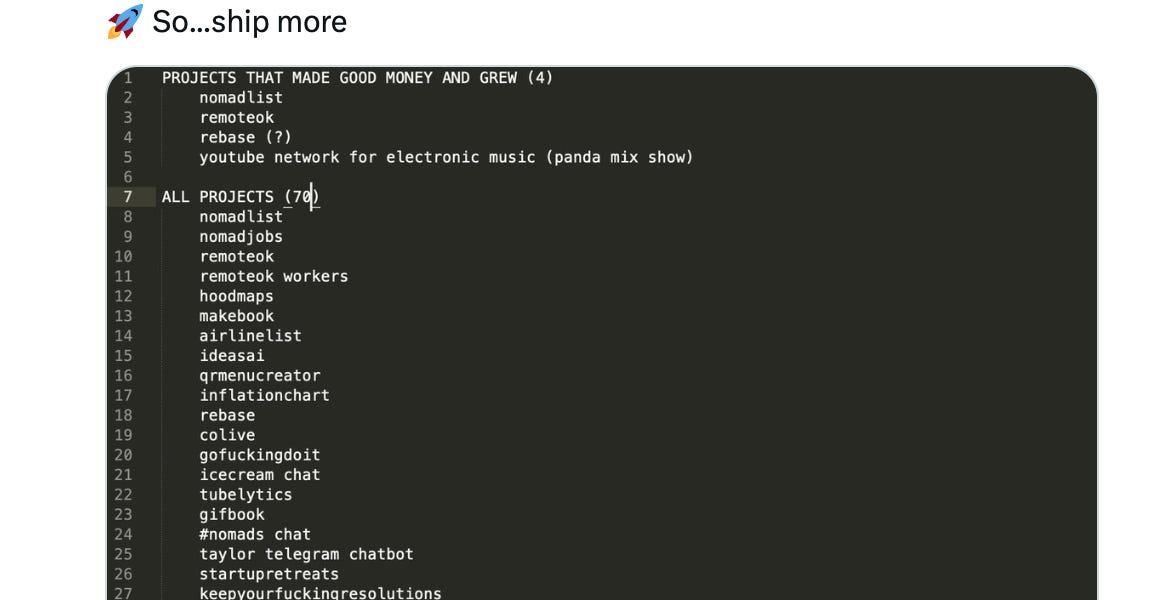

- The article provides several examples of solopreneurs like Pieter Levels and Blake Anderson who have built million-dollar businesses by rapidly iterating on ideas and products with the help of AI tools like ChatGPT.

[02] Implications for Tech Investing

1. How is the rise of AI-powered startups and solopreneurs impacting traditional tech investing models?

- The article suggests that the rise of AI-powered startups and solopreneurs is disrupting traditional tech investing in several ways:

- It is becoming easier and cheaper to build software, leading to more intense competition and shorter product lifetimes

- Many successful startups may not need to raise venture capital or go public, locking out traditional investors

- Venture capitalists face higher risks of startup failures and disruption of their existing investments by more capital-efficient competitors

2. What challenges do these trends pose for venture capitalists and public market investors?

- The article outlines several key challenges for investors:

- Venture capitalists may be locked out of the best AI-powered startups that can fund themselves through revenue

- The startups that do raise capital may need less funding, making it harder for VCs to deploy large amounts of capital

- Increased competition and disruption of existing businesses will make it harder for VCs to reliably generate returns from their investments

3. How might the role of the stock market change in this new tech landscape?

- The article suggests that the stock market's role as a wealth distribution engine may be disrupted, as successful AI-powered companies increasingly choose to remain private and not go public, locking out average investors.